How does tax regulation turn out to be legislation? – Ever puzzled how the ones tax rules all of us care for in reality get made? It is a interesting procedure, a little like a legislative sport of phone, however with far more bureaucracy and debate. It is not so simple as one particular person or workforce simply deciding what the foundations can be.

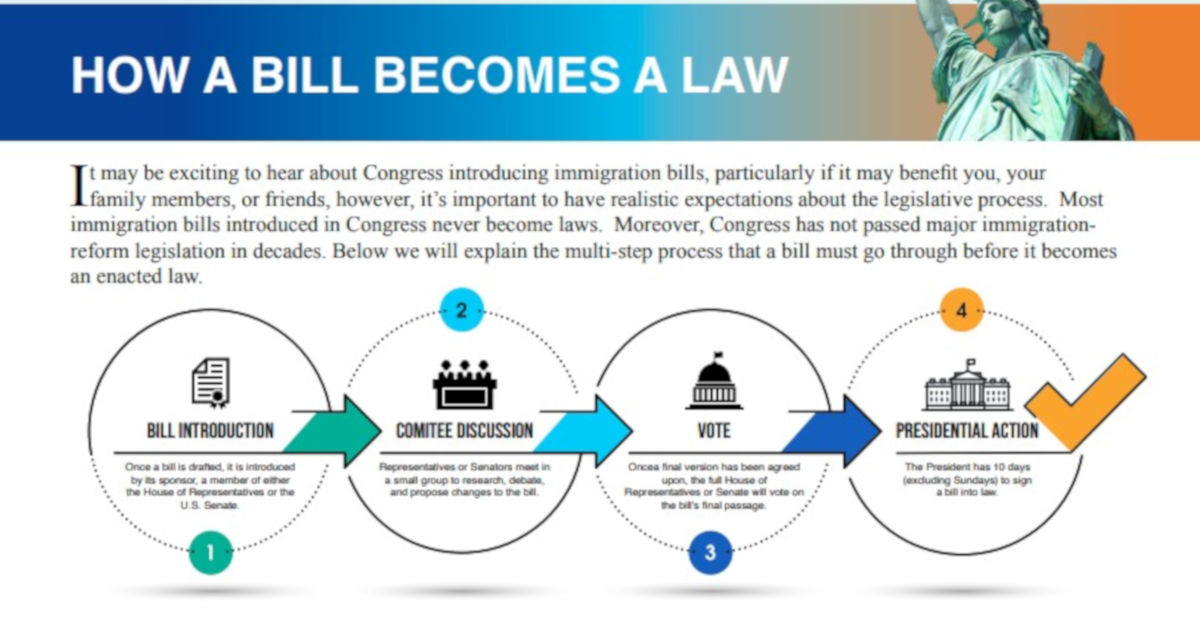

The adventure begins with an concept, steadily from a member of Congress, a presidential initiative, and even from electorate themselves. Those concepts can vary from tweaking present laws to making completely new ones. As soon as a suggestion is made, it is offered as a invoice within the Space or Senate.

The invoice then is going thru a chain of steps in each the Space and Senate. Bring to mind it as a committee device the place mavens read about each and every facet of the proposed regulation. Those committees debate the main points, cling hearings, and make adjustments to the invoice. There are steadily amendments proposed, and on occasion all the invoice is rewritten. This procedure permits for in depth enter and dialogue, and guarantees that the invoice is carefully vetted sooner than it even reaches the ground for a vote.

An important Steps within the Legislative Procedure:

- Advent: The invoice is offered in both the Space or Senate.

- Committee Evaluation: Explicit committees learn about and debate the invoice.

- Ground Debate: The invoice is mentioned and debated at the ground of the Space or Senate.

- Vote casting: Participants of the Space or Senate vote at the invoice.

- Convention Committee (if wanted): If the Space and Senate variations vary, a convention committee works to reconcile the diversities.

- Presidential Motion: The President can signal the invoice into legislation, veto it, or permit it to turn out to be legislation with no signature.

Bring to mind the method as a type of filtering device. Every step acts as a take a look at and stability, making sure the regulation is carefully thought to be and subtle sooner than it turns into legislation. It is a complicated device, however it is designed to make certain that tax rules are truthful and well-thought-out. And that is the reason the fundamental concept at the back of how tax regulation turns into legislation.

Who is Concerned?

- Congress: Senators and Representatives introduce and debate the expenses.

- Committees: Mavens inside Congress who analyze the regulation.

- The President: Has the facility to signal or veto regulation.

- Lobbyists: Folks or teams who recommend for or in opposition to explicit regulation.

- The Public: Electorate can specific their perspectives thru letters, emails, and public appearances.